Insurance Premiums and Covid-19 Vaccinations

*The following is for informational purposes only and should not be taken as medical advice. Please consult your physician to determine what is best for you*

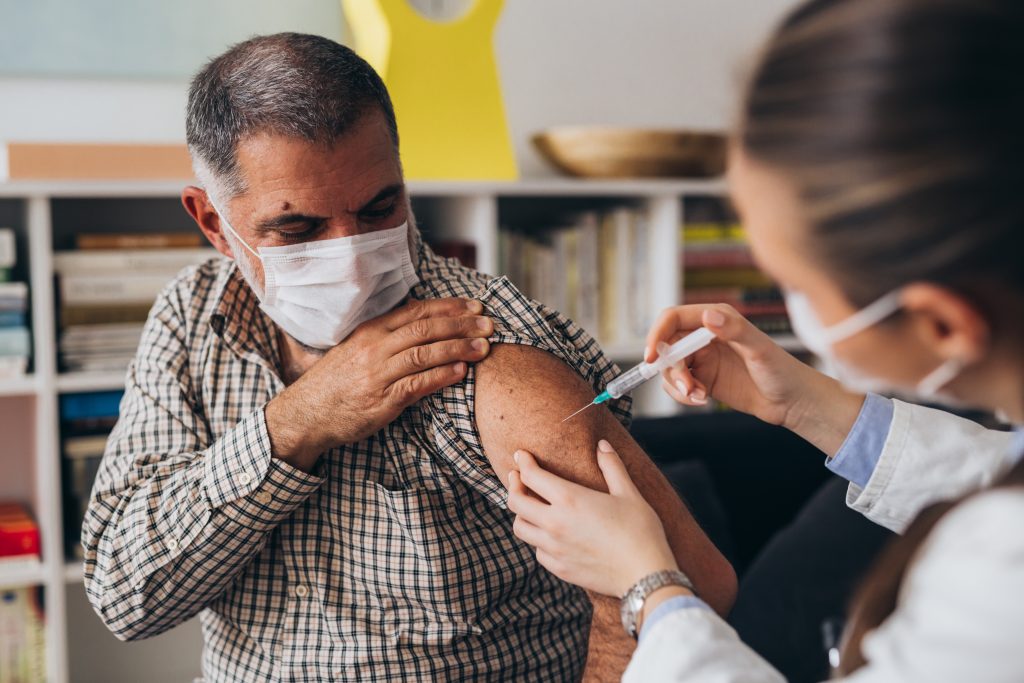

With the Pfizer vaccine receiving full FDA approval many companies are choosing to raise employee insurance premiums up to $200 should they decline to get vaccinated. Employers believe this will encourage more employees to get vaccinated. The big questions Americans are asking are “is this legal?” and “how does that work?”

The answer isn’t so black and white. Insurance providers cannot legally increase your premiums based on your vaccination status, much like they no longer can base premiums on past medical history or pre-existing conditions. With this new law, premiums can only be affected by geographical location, age, family size, and tobacco use. This, however, does not apply to employers that provide health insurance to employees. If your company pays for a portion of your insurance, they can make the decision to pay less should you deny the vaccination. Many try to compare Covid-19 to other seemingly preventable diseases like obesity, while employers claim that a chronic illness cannot affect those around you in the same way Covid-19 can.

Under Title VII of the Civil Rights Act, as well as many other employment laws, employers cannot withhold health insurance or require higher premiums based on ethnicity, race, gender, age, disabilities, religion, or other pre-existing conditions, however much like tobacco use, employers are allowed to add a surcharge for unvaccinated employees.

So, in less words, yes. It is legal for employers to apply a surcharge to your monthly premium should you choose not to receive the Covid vaccination. If you are faced with having to make the choice between paying the surcharge or receiving the vaccination, it is best to talk with your doctor about the risks and benefits of the vaccination for your personal situation.

When it comes to insurance, you may have other options. If you’d like to know more options, contact Sean the Insurance Guy for a free consultation today.